Advanced Trading Strategies with Exness’s Low Spreads

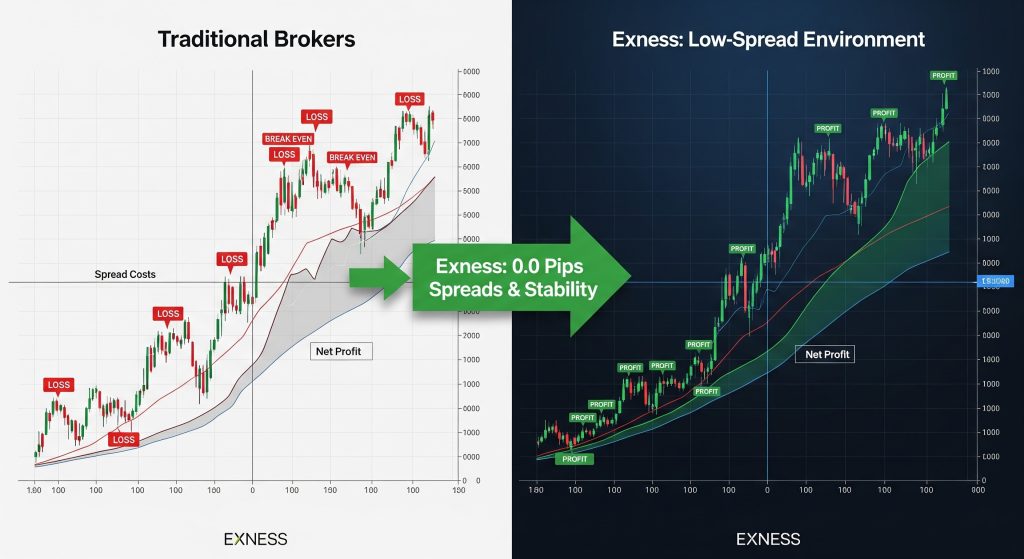

In the competitive world of forex trading, spread costs can make or break even the most sophisticated strategies. Exness has revolutionized the trading landscape by offering spreads starting from 0.0 pips and maintaining exceptional stability even during high-impact news events. This creates unprecedented opportunities for advanced trading strategies that were previously unprofitable due to high transaction costs. This comprehensive guide explores cutting-edge techniques specifically designed to maximize profits in Exness’s low spreads environment.

The Spread Advantage: Why It Matters for Advanced Strategies

Traditional forex strategies often fail because spread costs consume potential profits before traders can realize gains. With Exness offering low spreads on the top 30 instruments through their Zero account and maintaining spread stability that’s four times better than industry standards during news events, traders can implement sophisticated approaches that require:

- Frequent entries and exits: Scalping and high-frequency strategies become viable

- Tight profit targets: Small pip movements can generate meaningful returns

- News-based trading: Volatility strategies work without spread expansion penalties

- Arbitrage opportunities: Price discrepancies become profitable at smaller margins

- Grid and martingale systems: Multiple positions don’t compound spread costs exponentially

Ultra-High Frequency Scalping Systems

The 30-Second Momentum Scalp

This strategy exploits micro-movements in major currency pairs during peak liquidity hours, targeting 1-3 pip movements with surgical precision.

Optimal Setup:

- Account Type: Zero account for 0.0 pip spreads

- Currency Pairs: EUR/USD, GBP/USD, USD/JPY

- Trading Hours: London/New York overlap (12:00-16:00 GMT)

- Timeframe: 30-second to 1-minute charts

Entry Criteria:

- Price breaks above/below 5-period EMA on 30-second chart

- Stochastic oscillator confirms momentum (>80 for sells, <20 for buys)

- Volume surge confirmation (if available)

- No major news events within 30 minutes

Risk Management:

- Stop Loss: 2 pips maximum

- Take Profit: 2-4 pips (1:1 to 2:1 risk-reward)

- Maximum 5 simultaneous positions

- Daily loss limit: 2% of account balance

Why It Works with Exness

Zero spreads mean a 2-pip target yields 2 pips of pure profit instead of break-even results with traditional brokers.

The Breakout Fade Scalp

This contrarian approach profits from false breakouts that occur frequently in ranging markets.

Implementation:

- Identify established support/resistance levels on 5-minute charts

- Wait for initial breakout with increased volume

- When price fails to sustain breakout (returns within 10 pips), enter fade position

- Target return to opposite range boundary

Success Metrics:

- Win rate: 70-75% when properly executed

- Average risk-reward: 1:1.5

- Best performance during Asian session sideways markets

Advanced News Trading Strategies

The Economic Surprise Index Strategy

This sophisticated approach uses economic data surprises to predict post-news price movements with high accuracy.

Methodology:

- Track consensus estimates vs. actual results for key economic indicators

- Calculate standard deviations of historical surprises

- When actual data exceeds consensus by >1.5 standard deviations, trade in surprise direction

- Position size based on surprise magnitude

Key Economic Events:

- Non-Farm Payrolls (USD)

- ECB Interest Rate Decisions (EUR)

- Bank of England Rate Decisions (GBP)

- Reserve Bank of Australia Decisions (AUD)

Execution Parameters:

- Entry: Within 60 seconds of news release

- Target: 40-80 pips depending on surprise magnitude

- Stop Loss: 20-25 pips

- Maximum holding time: 4 hours

Exness Advantage:

Low spreads during news prevent the 5-10 pip spread widening that typically kills news trading profits.

The Central Bank Sentiment Shift Strategy

Concept:

Identify and capitalize on subtle changes in central bank communication that signal policy shifts before the market fully prices them in.

Implementation:

- Analyze central bank meeting minutes for dovish/hawkish language changes

- Compare current statements to previous 3 meetings using sentiment analysis

- Enter positions when sentiment shift exceeds predetermined threshold

- Scale positions based on strength of language changes

Risk Management:

- Position size: 1-3% risk per trade

- Time stop: Close positions before next central bank meeting

- Correlation limits: Maximum 60% portfolio correlation to single currency

Statistical Arbitrage and Pairs Trading

The Currency Correlation Breakdown Strategy

This strategy exploits temporary breakdowns in historically correlated currency relationships.

Popular Pairs:

- EUR/USD vs GBP/USD (normal correlation: 0.85)

- AUD/USD vs NZD/USD (normal correlation: 0.90)

- USD/CAD vs USD/NOK (normal correlation: 0.75)

Execution Method:

- Calculate 30-day rolling correlation coefficient

- When correlation drops below 0.5 (from normal >0.8), prepare for mean reversion

- Go long underperforming currency, short outperforforming currency

- Target return to normal correlation levels

Position Sizing:

- Equal dollar amounts in each currency pair

- Maximum 10-day holding period

- Exit when correlation returns to >0.7

Expected Returns:

- Average profit per trade: 15-25 pips per pair

- Win rate: 65-70%

- Maximum drawdown: 8-12%

Grid and Martingale Enhancement Systems

The Dynamic Range Grid 2.0

Traditional grid trading enhanced with volatility-adjusted spacing and intelligent position management.

Core Components:

- Volatility-Adjusted Grid Spacing: Use ATR(14) to set grid levels

- High volatility (ATR >15): 20-pip spacing

- Medium volatility (ATR 10-15): 15-pip spacing

- Low volatility (ATR <10): 10-pip spacing

Smart Position Sizing:

- Base lot size: 0.01 per $1,000 account balance

- Increase by 50% for each additional grid level

- Maximum 10 grid levels active simultaneously

Range Detection Algorithm:

- Identify ranging markets using ADX <25

- Set grid boundaries at 2-standard deviation Bollinger Bands

- Suspend grid during trending conditions (ADX >40)

Profit Optimization:

- Take profit: 50% of grid spacing

- Trail stops when 5+ consecutive profits achieved

- Break-even stops after 3 levels against trend

Exness Benefit:

Low spreads ensure each grid closure generates meaningful profit, making the strategy viable with smaller grid spacing.

High-Frequency Momentum Strategies

The Algorithm Detection System

This strategy identifies and follows institutional algorithmic trading patterns during specific market hours.

Pattern Recognition:

- London Open Algorithm (8:00-8:15 GMT):

- Monitor for 5-10 pip moves in under 2 minutes

- Volume spike >150% of 5-minute average

- Follow momentum with 15-pip targets

- NY Close Algorithm (21:00-22:00 GMT):

- Watch for position unwinding patterns

- Counter-trend opportunities when algorithms reverse

- Tight 8-pip stops, 12-pip targets

- Asian Range Algorithm (23:00-06:00 GMT):

- Identify mean-reversion algorithms

- Fade extreme movements >1.5 standard deviations

- Quick 5-pip scalps back to mean

Technology Requirements:

- Sub-second execution capability

- Level II market data (where available)

- Automated trade execution systems

- Low-latency internet connection

- The Volatility Expansion Breakout

Strategy Logic:

Capitalize on volatility expansion after prolonged periods of low volatility using Bollinger Band squeeze patterns.

Setup Criteria:

- Bollinger Bands reach narrowest width in 20 periods

- ATR drops below 10-period moving average

- Price consolidates for minimum 4 hours

- Volume decreases to below-average levels

Execution:

- Place pending orders 3 pips above/below Bollinger Bands

- Target: 2x the average daily range

- Stop: 1x the average daily range

- Cancel unfilled order when one triggers

Optimal Conditions:

- Works best on major pairs during European/US sessions

- Avoid during major news events

- Most effective after weekend gaps

Advanced Risk Management Techniques

The Kelly Criterion Position Sizing

Optimize position sizes using mathematical probability to maximize long-term returns while minimizing ruin risk.

Formula Application:

f = (bp – q) / b

Where:

- f = fraction of capital to wager

- b = odds of winning (pips gained/pips risked)

- p = probability of winning

- q = probability of losing (1-p)

Practical Implementation:

- Track strategy win rates over 100+ trades

- Calculate average win/loss ratio

- Apply Kelly formula with 25% reduction for safety

- Adjust position sizes weekly based on recent performance

The Correlation-Adjusted Portfolio Risk

Methodology:

- Calculate correlation matrix for all open positions

- Adjust effective portfolio risk using correlation coefficients

- Reduce position sizes when portfolio correlation >0.6

- Maximum effective portfolio risk: 6% regardless of individual position risks

Portfolio Optimization:

- Target correlation <0.3 between major positions

- Use negative correlations for natural hedging

- Rebalance weekly based on changing correlations

- Emergency correlation limits: Close positions if correlation >0.8

Technology and Platform Optimization

MetaTrader 5 Expert Advisor Configuration

Essential EAs for Advanced Strategies:

- Spread Monitor EA: Tracks real-time low spreads and alerts when conditions optimal

- Correlation Calculator EA: Real-time correlation monitoring

- News Filter EA: Automatically adjusts trading during high-impact events

- Risk Manager EA: Enforces position sizing and correlation limits

Platform Settings:

- Enable algorithmic trading

- Configure multiple timeframe analysis

- Set up custom indicators for each strategy

- Optimize execution settings for speed

Mobile Trading Optimization

Exness Trade App Configuration:

- Set price alerts for breakout levels

- Configure push notifications for economic events

- Enable one-click trading for scalping strategies

- Set up position monitoring dashboards

Performance Monitoring and Optimization

Key Performance Metrics

Strategy-Specific KPIs:

- Scalping Strategies:

- Trades per day: 20-50

- Win rate: >60%

- Average trade duration: <5 minutes

- Maximum consecutive losses: <5

- News Trading:

- Events traded per week: 3-8

- Average profit per event: 25-50 pips

- Success rate: >55%

- Maximum drawdown per event: <2%

- Grid Systems:

- Grid efficiency ratio: Profits/Active levels

- Maximum grid extension: <10 levels

- Recovery time: <48 hours

- Break-even rate: >80%

Continuous Improvement Process

Monthly Strategy Review:

- Analyze performance metrics against benchmarks

- Identify underperforming conditions/timeframes

- Adjust parameters based on recent market behavior

- Test modifications on demo account before implementation

Quarterly Strategy Overhaul:

- Complete backtesting with updated data

- Market regime analysis and strategy adaptation

- Technology upgrade and optimization

- Risk management review and enhancement

Common Pitfalls and Solutions

Over-Optimization Trap

Problem: Creating strategies that work perfectly on historical data but fail in live markets.

Solution:

- Use walk-forward optimization

- Implement robust out-of-sample testing

- Allow parameter flexibility ranges

- Regular live performance validation

Technology Dependence Risk

Problem: Over-reliance on automated systems without market understanding.

Solution:

- Maintain manual trading capabilities

- Understand all strategy logic completely

- Implement redundant execution methods

- Regular system maintenance and updates

Market Regime Blindness

Problem: Strategies fail when market conditions change fundamentally.

Solution:

- Implement regime detection indicators

- Maintain multiple strategy types

- Adjust position sizes during regime transitions

- Have defensive strategies ready

Last Moment Advanced Trading Strategies

Exness’s exceptional spread conditions create a unique environment where sophisticated trading strategies can flourish. The combination of zero spreads on major instruments, unprecedented spread stability during news events, and advanced trading platforms provides the foundation for implementing cutting-edge techniques that generate consistent profits.

Key Success Factors:

- Strategy Selection: Choose approaches that compound spread advantages

- Risk Management: Implement sophisticated position sizing and correlation controls

- Technology Integration: Leverage automated systems while maintaining market understanding

- Continuous Optimization: Regular performance monitoring and strategy refinement

- Market Adaptation: Flexibility to adjust approaches as conditions change

The strategies outlined in this guide represent the pinnacle of advanced forex trading, made possible by Exness’s industry-leading trading conditions. Success requires dedication, proper risk management, and continuous learning, but the potential rewards are substantial for traders who master these sophisticated approaches.

Remember that Advanced Trading Strategies require advanced skills. Start with thorough backtesting, implement robust risk management, and gradually scale your approach as you gain experience with Exness’s exceptional low-spread environment. The combination of cutting-edge strategies and optimal trading conditions creates unprecedented opportunities for consistent profitability in the dynamic forex market.