Exness safety is a top concern for traders who value trust and transparency in the world of online forex trading. The safety of your capital should always be your first priority when selecting a broker. With countless platforms available, distinguishing between legitimate, well-regulated brokers and risky operators can be difficult. Exness has built a reputation as a fortress of financial security, offering multiple layers of protection to ensure your funds remain safe in all conditions. This comprehensive analysis examines the strong regulatory structure and advanced security protocols that make Exness one of the most reliable and trusted brokers in global financial markets.

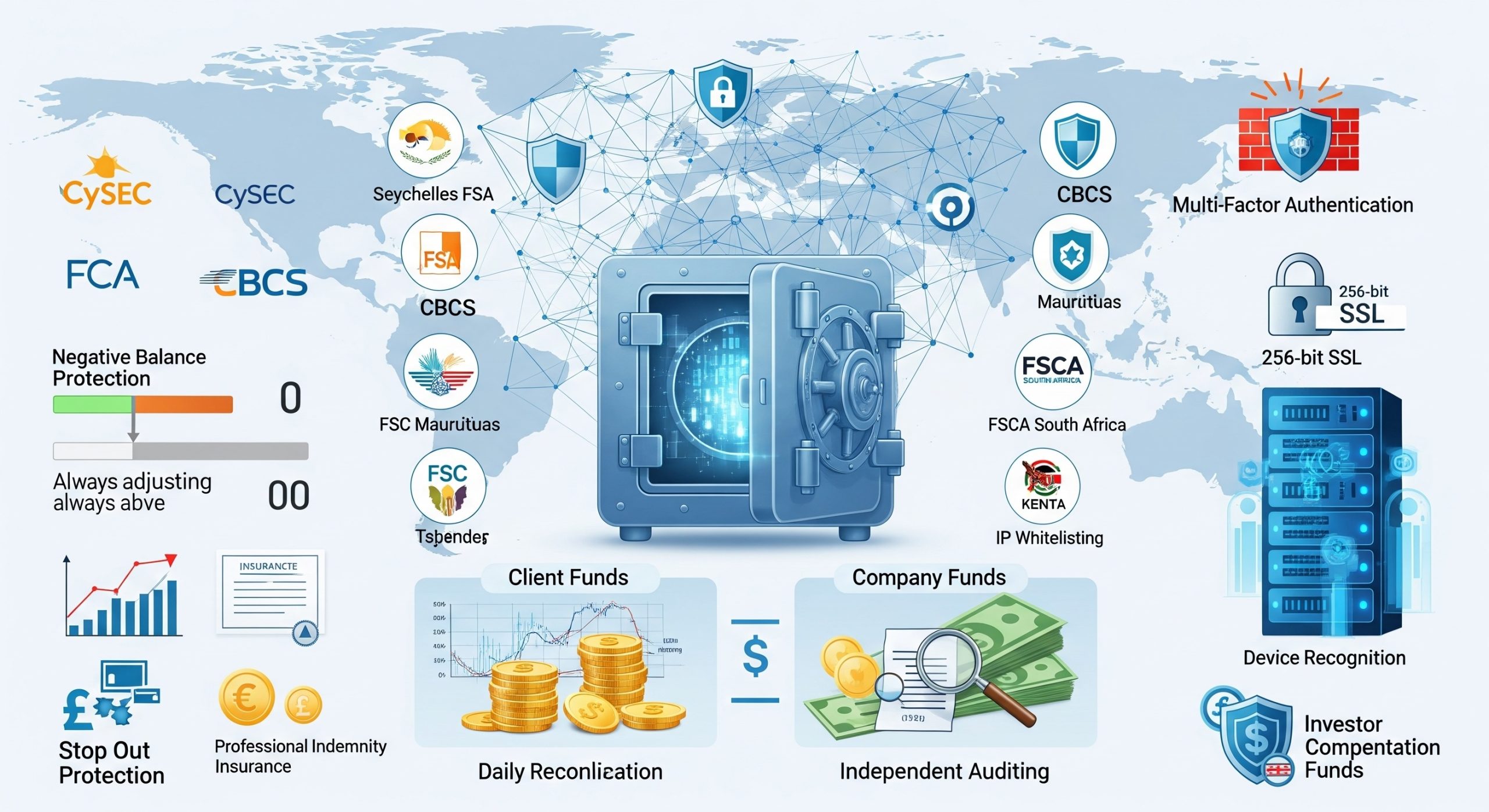

Multi-Jurisdictional Regulatory Framework

Exness operates under a comprehensive regulatory umbrella that spans multiple prestigious financial authorities worldwide. This multi-jurisdictional approach provides traders with unprecedented protection and ensures compliance with the highest international standards.

Primary Regulatory Licenses

Cyprus Securities and Exchange Commission (CySEC)

As a member of the European Union, CySEC operates under the Markets in Financial Instruments Directive (MiFID II), providing some of the world’s most stringent investor protection standards. This license ensures compliance with European banking regulations and provides access to the Investor Compensation Fund.

Financial Conduct Authority (FCA)

The UK’s FCA is renowned for its rigorous oversight and consumer protection measures. Exness (UK) Ltd operates under strict FCA regulations, ensuring adherence to the highest standards of business conduct and financial stability.

Seychelles Financial Services Authority (FSA)

The FSA provides regulatory oversight for international clients, maintaining strict compliance requirements while offering flexibility for global operations.

Central Bank of Curaçao and Sint Maarten (CBCS)

This license enables Exness to serve clients in specific jurisdictions while maintaining compliance with Caribbean banking standards.

Additional Regulatory Presence

Exness extends its regulatory footprint through licenses in:

- Financial Services Commission (FSC) Mauritius

- Financial Services Commission (FSC) British Virgin Islands

- Financial Sector Conduct Authority (FSCA) South Africa

- Capital Markets Authority (CMA) Kenya

- Jordan Securities Commission (JSC) – Registered and regulated

Segregated Client Accounts: Your Money, Completely Separate

One of the most critical aspects of fund protection is the segregation of client funds from company operational funds. Exness maintains a strict segregation policy that ensures your trading capital can never be used for company operations, regardless of circumstances.

How Segregation Works

Tier 1 Banks Partnership

Exness partners exclusively with top-tier international banks to hold client funds. These banks are selected based on their financial stability, regulatory compliance, and reputation in the global banking sector.

Daily Reconciliation

Client account balances are reconciled daily to ensure that segregated funds always match or exceed the total of all client deposits and trading profits. This process provides real-time verification that your funds are fully accounted for and protected.

Independent Auditing

Regular independent audits by internationally recognized accounting firms verify the proper segregation of client funds. These audits provide transparent confirmation that segregation protocols are followed without exception.

Legal Protection Framework

Statutory Trust

Client funds are held in statutory trust accounts, creating a legal barrier that prevents these funds from being accessed for any purpose other than client transactions and withdrawals.

Insolvency Protection

In the unlikely event of company insolvency, segregated client funds are legally protected and would be returned to clients as they are not considered company assets.

Advanced Security Infrastructure

Exness has invested extensively in cutting-edge security technologies to protect both client funds and personal data from cyber threats and unauthorized access.

Multi-Layer Cybersecurity

PCI DSS Level 1 Compliance

As the highest level of Payment Card Industry Data Security Standard compliance, this certification ensures that all card transactions and data storage meet the most stringent security requirements used by major financial institutions.

SSL Encryption Technology

All data transmission between clients and Exness servers utilizes 256-bit SSL encryption, the same standard used by major banks and government institutions.

Web Application Firewall (WAF)

Advanced firewall protection shields Exness infrastructure from web-based attacks, including SQL injection, cross-site scripting (XSS), and distributed denial-of-service (DDoS) attacks.

Zero Trust Security Architecture

Multi-Factor Authentication (MFA)

Optional but highly recommended MFA adds an extra layer of account protection through SMS codes, email verification, or authenticator applications.

Device Recognition Technology

Advanced algorithms detect unusual login patterns and device usage, automatically flagging suspicious activities for additional verification.

IP Whitelisting

Clients can restrict account access to specific IP addresses, providing an additional layer of protection for high-value accounts.

Negative Balance Protection

Exness provides automatic negative balance protection across all account types, ensuring that clients cannot lose more than their deposited capital, regardless of market conditions or leverage used.

How Exness Safety Works?

Real-Time Monitoring

Advanced risk management systems monitor account equity in real-time, automatically closing positions before negative balances can occur.

Automatic Reset

In extreme market conditions where negative balances might occur due to gaps or slippage, Exness automatically resets account balances to zero, absorbing any negative balance.

No Additional Charges

Unlike some brokers that may pursue clients for negative balances, Exness never seeks additional payments from clients, providing complete peace of mind.

Proprietary Stop Out Protection

Exness has developed innovative Stop Out Protection technology that helps preserve client capital during volatile market conditions.

Advanced Features

Volatility Detection

Sophisticated algorithms detect periods of extreme market volatility and automatically adjust stop out procedures to protect client positions.

Delayed Stop Outs

During high-impact news events or extreme volatility, the system may delay stop outs to prevent unnecessary losses caused by temporary price spikes.

Position Recovery

In some cases, positions that would normally be stopped out are given additional time to recover, potentially saving clients from unnecessary losses.

Insurance and Compensation Schemes

Beyond regulatory requirements, Exness provides additional layers of financial protection through insurance and compensation programs.

Professional Indemnity Insurance

Exness maintains comprehensive professional indemnity insurance that covers:

- Errors and omissions in service delivery

- Technology failures affecting client accounts

- Operational risks that could impact client funds

Investor Compensation Funds

Through its European licenses, Exness clients have access to:

- Cyprus Investor Compensation Fund: Up to €20,000 per client

- UK Financial Services Compensation Scheme (FSCS): Up to £85,000 per client (where applicable)

Transparent Financial Reporting

Exness maintains complete transparency in its financial operations through regular public reporting and disclosure.

Annual Audited Reports

Independently audited annual reports provide detailed information about:

- Company financial position

- Client fund segregation compliance

- Risk management procedures

- Regulatory compliance status

Real-Time Fund Verification

Clients can verify fund security through:

- Real-time account balance verification

- Transaction history transparency

- Segregated account confirmation statements

Data Protection and Privacy

Personal and financial data protection is paramount at Exness, with comprehensive measures ensuring complete privacy and security.

GDPR Compliance

Full compliance with the European General Data Protection Regulation (GDPR) ensures:

- Strict data usage limitations

- Right to data portability

- Secure data deletion procedures

- Transparent privacy policies

Advanced Data Encryption

All client data is protected through:

- AES-256 encryption for data at rest

- TLS 1.3 for data in transit

- Regular security key rotation

- Secure backup procedures

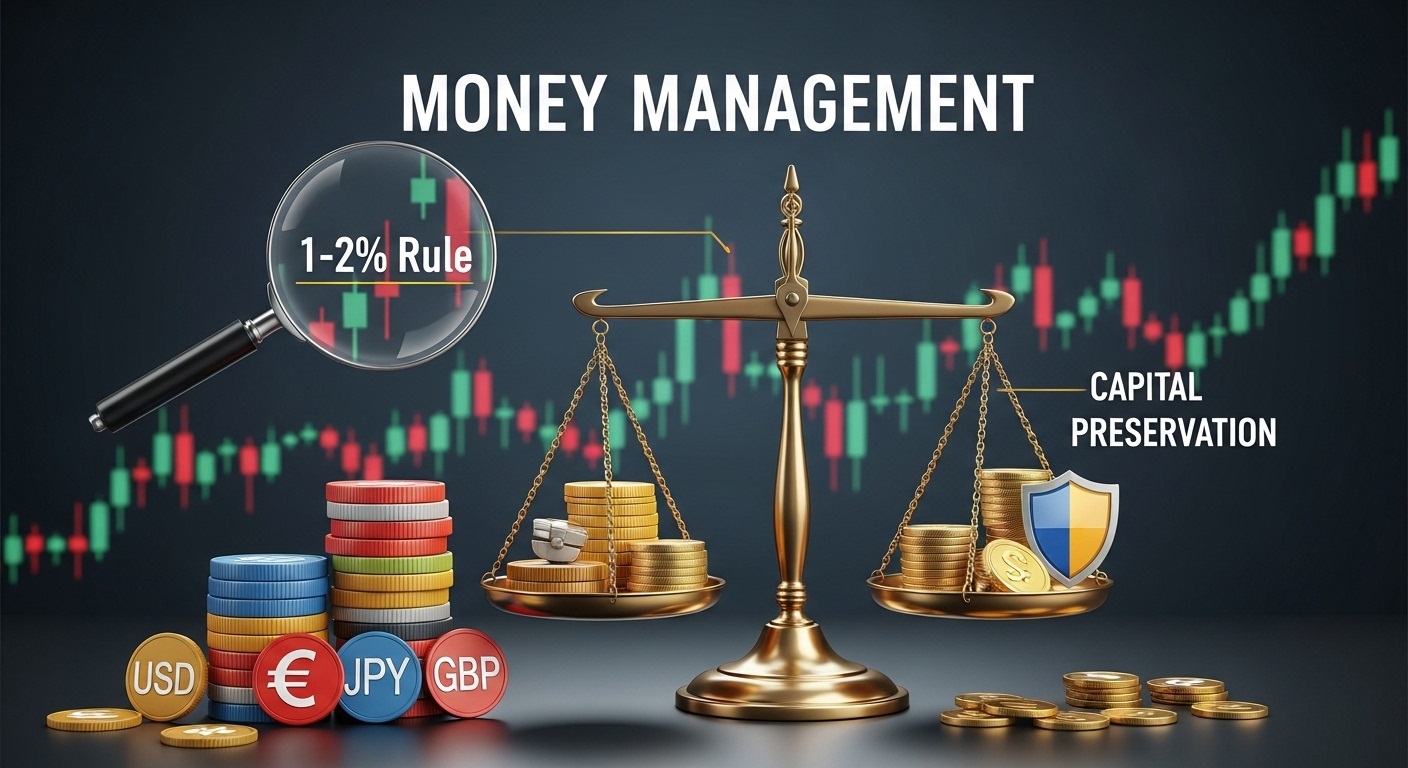

Risk Management Excellence

Exness employs sophisticated risk management systems that protect both the company and its clients from various market and operational risks.

Dynamic Risk Controls

Real-Time Position Monitoring

Advanced systems continuously monitor all client positions and market exposure to ensure balanced risk distribution.

Liquidity Management

Partnerships with multiple tier-1 liquidity providers ensure adequate market depth and price stability even during volatile conditions.

Counterparty Risk Mitigation

Diversified liquidity partnerships and hedging strategies minimize counterparty risks that could affect client trading.

Regular Security Audits and Penetration Testing

Exness conducts regular security assessments to identify and address potential vulnerabilities before they can be exploited.

Third-Party Security Audits

Independent cybersecurity firms regularly test Exness systems for:

- Vulnerability assessment

- Penetration testing

- Social engineering resistance

- Infrastructure security evaluation

Bug Bounty Program

Exness maintains an active bug bounty program that rewards security researchers for identifying potential vulnerabilities, creating an additional layer of proactive security monitoring.

Crisis Management and Business Continuity

Comprehensive crisis management procedures ensure continuous operations and fund protection even during extreme circumstances.

Disaster Recovery Systems

- Multiple data center locations with real-time replication

- Automated failover systems for uninterrupted service

- Regular disaster recovery testing and updates

Emergency Fund Access

Special procedures ensure client fund access even during emergency situations, with multiple backup systems and manual override capabilities when necessary.

Why Your Funds Are 100% Protected

The combination of multiple regulatory licenses, segregated accounts, advanced security technology, insurance coverage, and comprehensive risk management creates an impenetrable shield around your trading capital. Exness has designed its entire operational framework with one primary goal: ensuring that client funds remain completely safe under all circumstances.

Key Protection Elements:

- Regulatory Compliance: Multiple licenses from top-tier financial authorities

- Fund Segregation: Complete separation of client and company funds

- Insurance Coverage: Multiple layers of financial protection

- Advanced Security: Bank-level cybersecurity infrastructure

- Transparent Operations: Open reporting and regular auditing

- Risk Management: Sophisticated systems preventing losses

- Crisis Planning: Comprehensive business continuity procedures

Conclusion

Exness has established the gold standard for Exness safety and client fund protection in the forex industry. Through its multi-jurisdictional regulatory approach, advanced security infrastructure, and comprehensive risk management systems, the broker provides an unparalleled level of safety for client funds.

The combination of segregated accounts held with tier‑1 banks, multiple insurance policies, regulatory oversight from prestigious financial authorities, and cutting‑edge security technology ensures that your trading capital remains completely protected regardless of market conditions or external circumstances.

For traders seeking absolute peace of mind regarding fund protection, Exness safety represents the pinnacle of financial security in online trading. The broker’s unwavering commitment to client protection, transparent operations, and regulatory compliance makes it the ideal choice for traders who prioritize capital safety alongside competitive trading conditions.

When you trade with Exness, you’re not just choosing a broker – you’re choosing a financial fortress built on Exness safety principles, designed to protect and preserve your trading capital while providing the tools and conditions necessary for trading success.