Establishing Risk Parameters

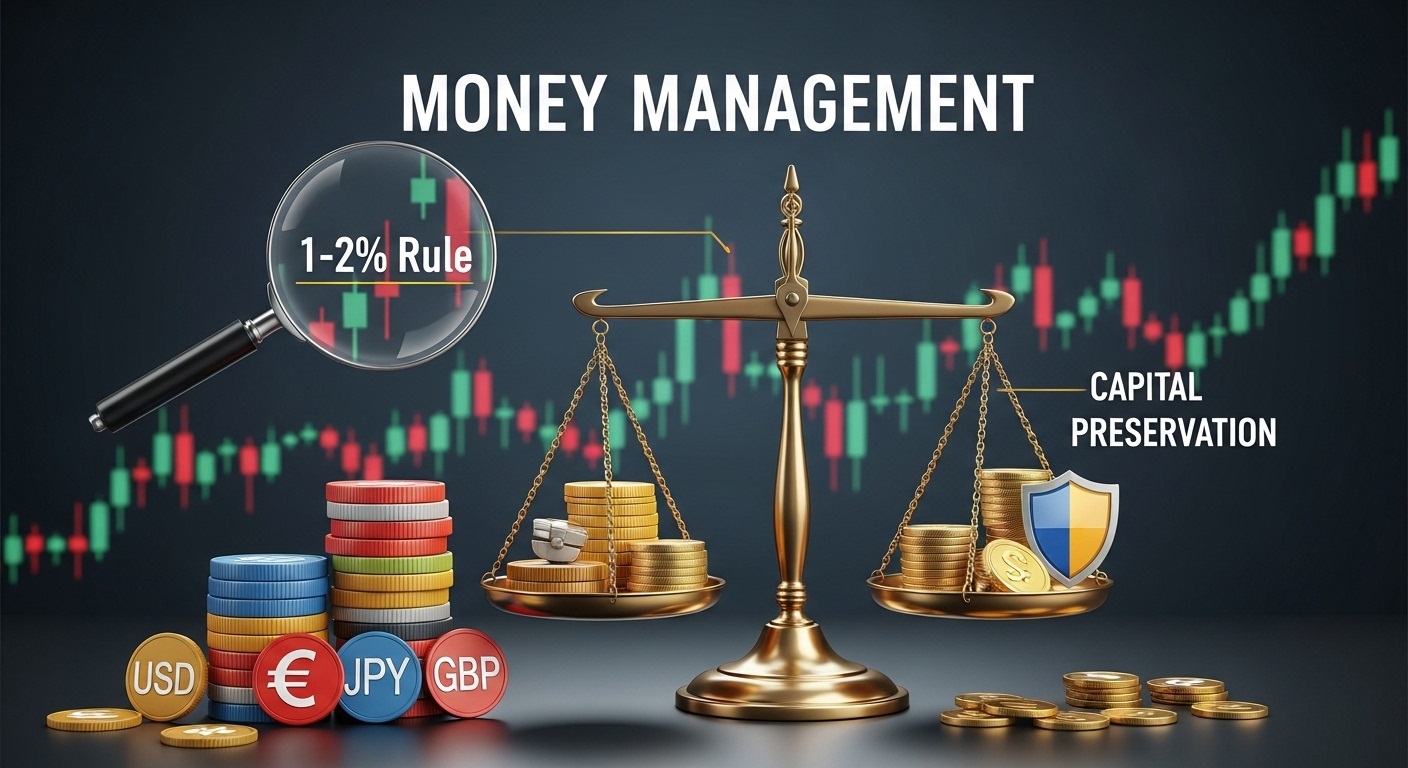

Effective Money Management in forex trading begins with setting clear risk parameters for each position. Traders should determine a fixed percentage of their capital—commonly 1–2%—to risk per trade. This approach limits the impact of individual losses and preserves trading equity during drawdown periods. By combining position sizing with well-placed stop-loss orders, traders ensure that no single market swing can derail their overall strategy, fostering endurance and consistency in volatile currency markets.

Diversifying and Scaling Positions

A robust Money Management plan emphasizes diversification across currency pairs and trade durations. Allocating capital to both major and minor pairs spreads exposure, while mixing short-term and swing trades balances profit opportunities against market noise. As trading performance stabilizes, scaling position sizes gradually—based on accumulated gains—allows traders to compound profits responsibly. This tiered scaling method prevents overleveraging and maintains disciplined growth.

Monitoring and Adapting Your Plan

Continuous evaluation is vital for successful forex Money Management. Traders should review open positions, analyze performance metrics, and adjust risk limits in response to shifting market conditions. Regularly revisiting trading journals helps identify patterns, refine entry and exit rules, and optimize capital allocation. Adapting Money Management rules to evolving volatility and liquidity ensures traders maintain control, minimize emotional impulses, and steadily build long-term profitability.