Embarking on Forex trading for beginners begins in the mind. Before placing a single order, assess your motivation and expectations. Are you seeking a steady side income or aiming for full-time trading? Clarifying your goals prevents emotional decisions when markets swing. Take time to research currency pairs, market hours, and the economic factors that drive exchange rates.

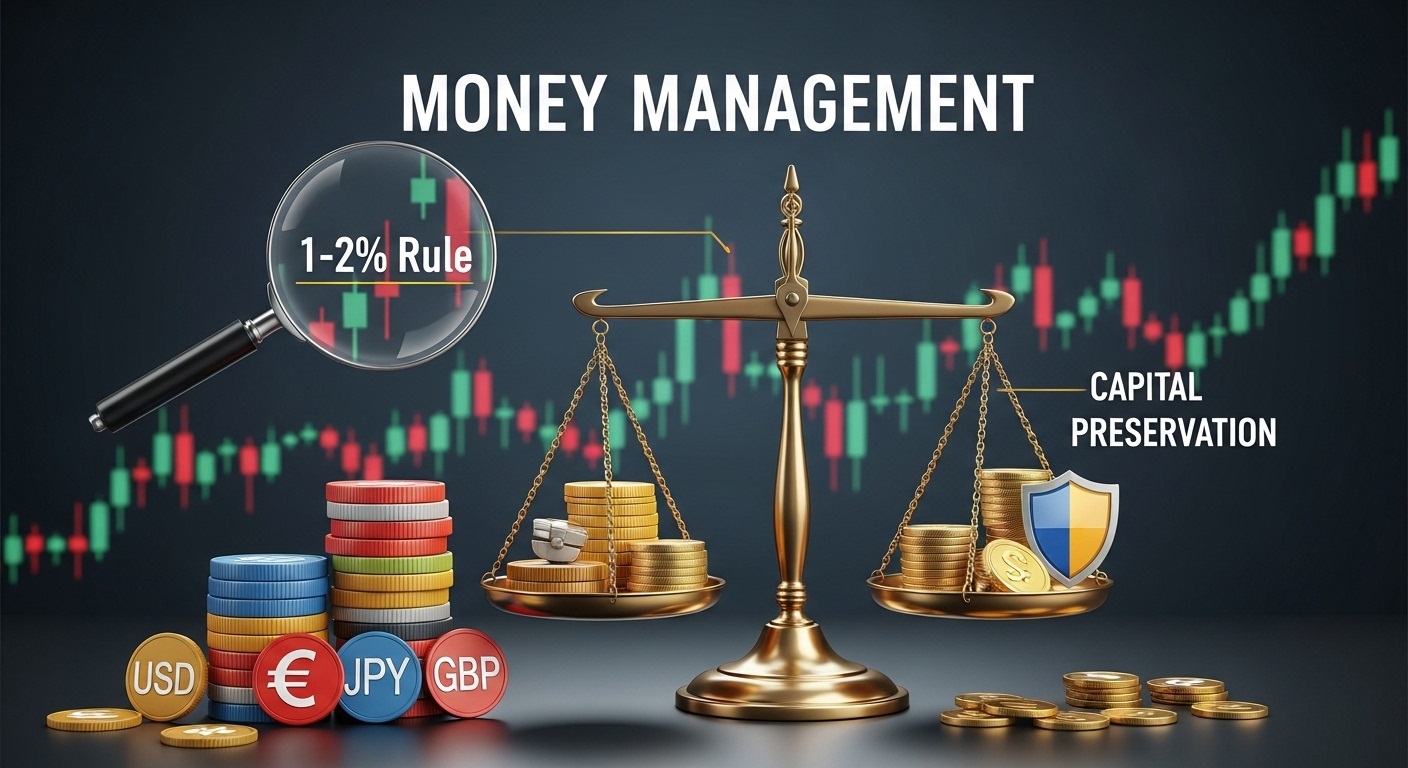

Next, evaluate your risk tolerance and capital allocation. Determine how much of your total funds you can comfortably risk without compromising essential expenses. Establish clear stop-loss and take-profit levels to protect your account from unexpected volatility. By setting realistic risk parameters, you’ll trade with confidence rather than fear, a crucial mindset for beginner forex traders.

Support and Resistance

Support and Resistance

Support and resistance levels are key in Forex trading for beginners. Support acts as a floor where prices often bounce higher, while resistance serves as a ceiling where prices reverse downward. Identifying these zones on charts guides entry and exit points, enhancing risk management and trade timing.

Finally, prepare a structured trading plan and toolkit. Choose a reliable trading platform and demo account to practice strategies without real money. Develop a routine for analyzing charts, reviewing news, and journaling your trades. A disciplined approach, combining technical tools and a sound plan, lays the foundation for consistent progress in forex trading for beginners.