Successful trading requires mastering stop loss and take profit strategies to maximize returns while minimizing risks. Understanding Profit Calculation is essential for protecting your capital and achieving consistent gains in any market condition.

Understanding Stop Loss in Trading

A stop loss order automatically closes your position when prices move against you. This protective mechanism prevents catastrophic losses and removes emotional decision-making from your trading. Every profitable trader incorporates stop loss strategies into their Profit Calculation framework.

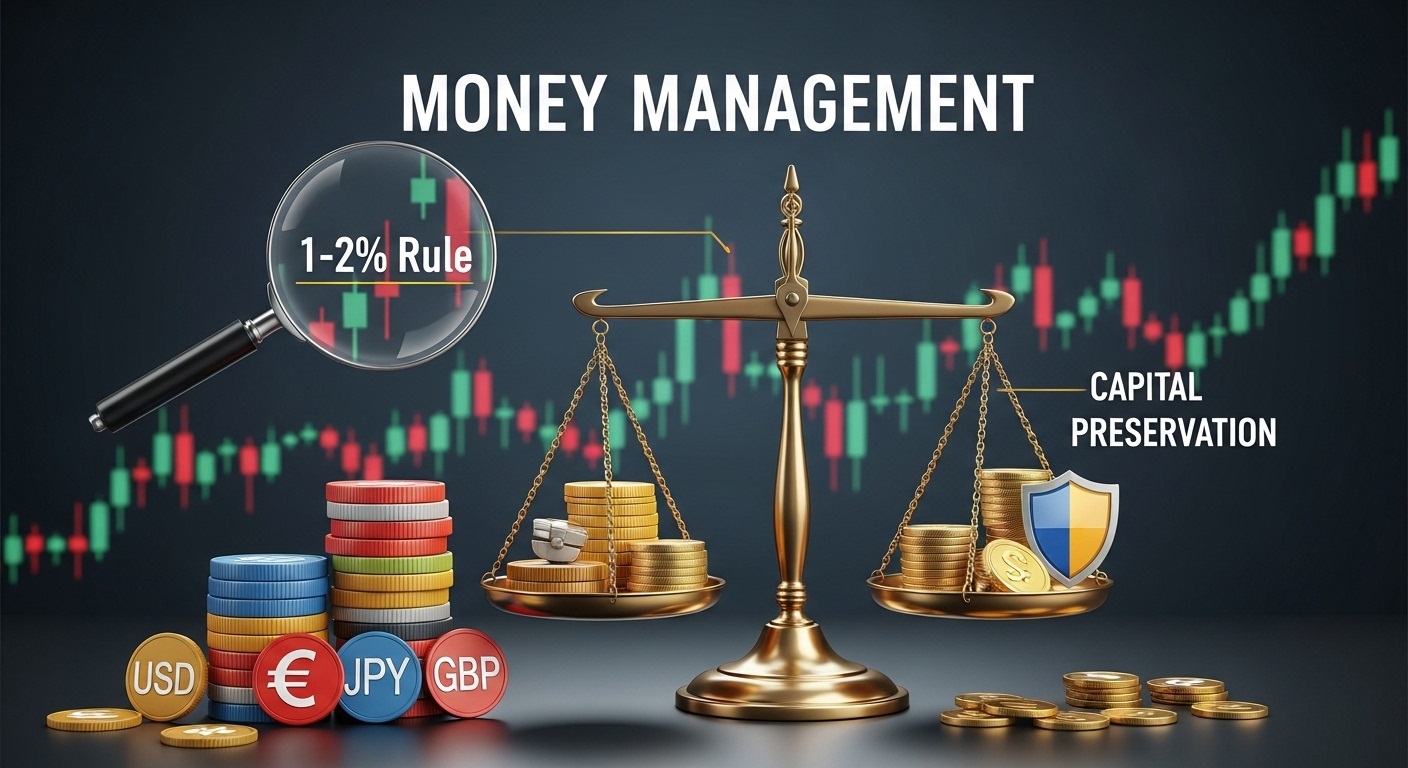

Setting appropriate stop loss levels depends on market volatility, asset type, and your risk tolerance. Conservative traders typically risk 1-2% of their total capital per trade. This disciplined approach to Profit Calculation ensures long-term account survival.

Take Profit: Securing Your Gains

Take profit orders lock in gains by closing positions once your target price is reached. Without predetermined exit points, greed can erode profits quickly. Strategic Profit Calculation helps you capture gains before market reversals occur.

The risk-to-reward ratio forms the foundation of effective Profit Calculation. Professional traders commonly use ratios like 1:2 or 1:3, meaning they target twice or thrice their risked amount. This mathematical approach ensures profitability even with moderate win rates.

Calculating Stop Loss Levels

Percentage-based stop loss is the simplest method for beginners. If you risk 2% on a $10,000 account, your maximum loss per trade is $200. This straightforward Profit Calculation method maintains consistency across all trades regardless of asset or market conditions.

Volatility-based stop loss uses indicators like Average True Range (ATR) to determine exit points. During high volatility, stops are placed farther from entry prices. This dynamic Profit Calculation adapts to changing market conditions effectively.

Support and resistance levels provide logical stop loss placements. Position your stop slightly below support for long positions or above resistance for short positions. This technical Profit Calculation aligns with natural market structure and price behavior patterns.

Take Profit Calculation Methods

Fixed take profit targets use specific price levels based on technical analysis. Identify key resistance areas for long trades or support zones for short trades. Accurate Profit Calculation requires understanding where price typically stalls or reverses direction.

Trailing stop loss combines both protective and profit-securing functions. As prices move favorably, your stop loss adjusts upward automatically. This advanced Profit Calculation technique maximizes gains during strong trending markets while protecting accumulated profits.

Fibonacci retracement levels offer precise take profit targets based on mathematical ratios. Common levels include 38.2%, 50%, and 61.8% retracements. Incorporating Fibonacci into your Profit Calculation adds scientific precision to exit strategies.

Risk-to-Reward Ratio Optimization

Maintaining a minimum 1:2 risk-to-reward ratio is crucial for profitable Profit Calculation. Even with a 50% win rate, you’ll remain profitable long-term. This mathematical edge separates successful traders from those who consistently lose money.

Calculate your risk-to-reward before entering any trade. If your stop loss is 50 pips away, your take profit should be at least 100 pips distant. This disciplined Profit Calculation approach prevents impulsive trading decisions.

Position Sizing and Profit Calculation

Position sizing directly impacts your Profit Calculation effectiveness. Larger positions require tighter stops or smaller risk percentages. Calculate position size using the formula: (Account Risk ÷ Stop Loss Distance) × Account Size for optimal results.

Never risk more than you can afford to lose. Professional traders rarely exceed 1-2% risk per position. Conservative Profit Calculation and position sizing protect your trading capital during inevitable losing streaks.

Technical Indicators for Better Calculation

Moving averages help identify trend direction and potential exit points. When price crosses major moving averages, consider taking profits or tightening stops. Integrating indicators improves your Profit Calculation accuracy significantly.

Bollinger Bands show volatility and potential reversal zones. Price touching the upper band signals potential take profit opportunities for long positions. Using multiple indicators strengthens your Profit Calculation strategy and decision-making process.

RSI and MACD provide momentum signals for optimal exit timing. Divergence patterns often precede reversals, making them valuable for Profit Calculation. Combine momentum indicators with price action for comprehensive trading strategies.

Backtesting Your Strategy

Test your stop loss and take profit levels using historical data before risking real capital. Backtesting reveals the effectiveness of your Profit Calculation methods across different market conditions and timeframes.

Track win rate, average profit, and maximum drawdown during backtesting. Adjust your Profit Calculation parameters based on results. Continuous improvement through data analysis separates profitable traders from unsuccessful ones.

Common Mistakes to Avoid

Moving stop loss levels to avoid being stopped out destroys your Profit Calculation plan. Stick to predetermined levels regardless of temporary price fluctuations. Discipline ensures your risk management strategy remains effective over time.

Setting unrealistic take profit targets leads to missed opportunities. Market conditions determine realistic targets. Adaptive Profit Calculation based on current volatility and price structure yields better results than arbitrary targets.

Implementing Your Strategy

Use trading calculators and risk management tools for precise Profit Calculation. Many platforms offer built-in calculators that determine optimal position sizes and stop loss levels instantly based on your risk parameters.

Document every trade in a trading journal. Record entry price, stop loss, take profit, and actual outcome. Analyzing your Profit Calculation performance identifies patterns and areas for improvement.

Final Thought

Mastering stop loss and take profit Calculation is fundamental to trading success. Combine technical analysis, risk management principles, and disciplined execution for consistent profitability. Start implementing these strategies today to transform your trading results.