Is Forex trading a good idea?

A Simple Guide to Help You Decide

Forex trading means buying and selling different currencies to make money from price changes. It’s the biggest financial market in the world, with more than six trillion dollars traded every day. Many people wonder if forex trading is a smart choice for them. The answer depends on your goals, how much risk you can handle, and whether you’re ready to spend time learning how it works.

What Is the Forex Trading Idea All About?

The forex market is open twenty-four hours a day, five days a week. It never sleeps because trading happens across different time zones in cities like London, New York, Tokyo, and Sydney. Unlike the stock market that closes at a certain time, you can trade forex almost anytime that suits your schedule. This flexibility makes it attractive to people with busy lives or different working hours.

In forex trading, you work with currency pairs like EUR/USD or GBP/JPY. You’re basically predicting whether one currency will go up or down compared to another. The market doesn’t have one single location or boss controlling everything. Instead, it’s a network of banks, brokers, and traders all connected electronically. This setup creates lots of opportunities but also means you need to be careful and well-informed.

Why People Love the Forex Trading Idea

The forex trading idea attracts millions of people because it offers several benefits you won’t find in other markets. The biggest advantage is high liquidity, which means you can buy and sell quickly without moving prices too much. This happens because so many people trade forex every day, creating a very active market with plenty of buyers and sellers available at all times.

Another great thing about forex is that you don’t need tons of money to start. Some brokers let you open accounts with just a few hundred dollars. Many also offer practice accounts where you can learn without risking real money. This makes forex more accessible than investments like real estate or certain stocks that need large amounts of cash upfront.

The twenty-four-hour schedule gives you freedom to trade whenever you want. Whether you work full-time during the day or prefer trading at night, the forex market is always running. You can trade around your job, family time, or other commitments. The best part is when major trading sessions overlap, creating more action and opportunities to make trades.

Forex also offers something called leverage, which lets you control big positions with small amounts of money. For example, with one hundred-to-one leverage, you could control ten thousand dollars with just one hundred dollars of your own money. This can multiply your profits, but remember it also multiplies your losses, so you must be very careful with leverage.

The Real Risks of Forex Trading You Need to Know

While the forex trading idea sounds exciting, it comes with serious risks that can hurt your wallet. Currency prices change fast based on news, economic reports, political events, and sudden market moves. These quick changes can make you money, but they can also cause big losses, especially when you’re using leverage to trade with borrowed money.

Leverage is actually one of the biggest dangers in forex trading. Yes, it can boost your wins, but it can wipe out your account just as easily. With one hundred-to-one leverage, if the market moves just one percent against you, you could lose everything. This is why many beginners lose money in forex. Studies show that seventy to ninety-five percent of regular people who try forex trading end up losing their money.

Learning forex trading takes a long time and lots of practice. Most beginners need at least one to three months just to understand the basics like currency pairs, pips, spreads, and how leverage works. Getting good enough to make steady profits usually takes six months to two years, and some traders need even longer. You can’t rush this learning process, and you’ll probably lose some money along the way while you figure things out.

The emotional side of trading is harder than most people think. Fear makes you close winning trades too early. Greed makes you hold losing trades too long. Hope makes you ignore warning signs. These feelings can mess up your decisions and cause you to break your own rules. Many traders feel stressed and anxious from watching their money go up and down. If you can’t handle this emotional pressure, forex trading will be very difficult for you.

Choosing a Safe Broker Is Critical

Picking the right broker is extremely important when you start forex trading. You need a broker that’s regulated by official government agencies like the Financial Conduct Authority in the UK, the Commodity Futures Trading Commission in the US, or similar organizations in other countries. These regulators make sure brokers follow rules that protect your money and treat you fairly.

Never trade with unregulated brokers because they can manipulate prices, refuse to let you withdraw money, charge hidden fees, or even steal your deposit. Without regulation, you have no protection and nowhere to complain if something goes wrong. Always check that a broker is properly regulated before you put any money into an account. This simple step can save you from losing everything to a dishonest company.

Smart Risk Management Keeps You Safe

Using good risk management is the most important skill for surviving in forex trading. The simplest protection is a stop-loss order, which automatically closes your trade if it goes too far against you. This limits how much you can lose on any single trade. Most experienced traders never risk more than one to two percent of their total account on one trade. This means even if you lose ten trades in a row, you’ll still have eighty percent or more of your money left.

Position sizing means figuring out exactly how much to trade based on your account size and how much risk you’re comfortable with. Don’t just guess or trade the same amount every time. Use simple calculators to figure out proper trade sizes so every trade fits your risk management plan. Also, make sure your potential profit is at least twice as big as your potential loss on each trade. This way, you can lose more trades than you win and still make money overall.

Other smart strategies include spreading your trades across different currency pairs instead of putting everything in one trade. Keep your leverage low, even if your broker offers high leverage. Avoid trading on weekends when prices can jump unpredictably based on events that happen while markets are closed. These simple rules can help protect your account from disaster.

Controlling Your Emotions Is Just as Important as Strategy

Your mindset and emotions matter just as much as your technical knowledge. The best traders stick to their plans no matter how they feel in the moment. They don’t make sudden decisions based on fear or excitement. You need to develop this kind of discipline if you want to succeed in forex trading.

Keeping a trading journal helps you learn from your mistakes and improve over time. Write down not just your trades but also how you felt when you made them and why you made those decisions. Looking back at this journal shows you patterns in your behavior that you can work on improving. Take breaks after big wins or loses so you don’t make emotional decisions while you’re excited or upset.

Simple routines like deep breathing, meditation, or planning how you’ll react to different situations can help you stay calm. Remember that your physical health affects your mental performance too. Get enough sleep, exercise regularly, and eat well. These basic habits support better decision-making and help you handle the stress of trading.

So, Is Forex Trading Really Worth It?

Whether the forex trading idea makes sense for you depends on your personal situation and expectations. Forex is not for people who hate taking risks or who want to get rich quickly without putting in serious effort. The fact that eighty-five to ninety-five percent of regular traders lose money should make you think very carefully before starting.

However, forex can work for people who approach it the right way. You need realistic expectations, money you can afford to lose completely, lots of education, strict risk management, and strong emotional control. Think of forex as a long journey, not a quick trip. You’ll need to keep learning, test your strategies carefully, and stay disciplined even when things get tough. People who invest time in learning, practice on demo accounts first, and treat trading like a serious skill have better chances of eventually making consistent profits.

If you handle risk well, enjoy analyzing markets, can control your emotions, have time to dedicate to learning, and understand both the rewards and challenges, then exploring the forex trading idea might be right for you. But if you want guaranteed returns, fast money without work, or can’t afford to lose your investment, then forex trading is definitely not a good choice. Before you risk any real money, spend time learning about how forex works, practice extensively with free demo accounts, start with very small trades, and never risk money you actually need for bills or living expenses.

Ready to Start Your Forex Trading Journey?

Now that you understand what forex trading is really about, both the exciting opportunities and the real risks, you might be ready to take the next step. Learning from reliable sources and getting professional guidance can help you avoid common beginner mistakes and build a solid foundation for success.

Why do 98% of Forex traders lose money?

The Hard Truth About Forex Trading

Most forex traders lose money. Research shows 70–90% fail within months. This is not a secret. It’s a documented fact from brokers and regulators.

The European Securities and Markets Authority confirms it. Between 74–89% of retail traders lose money. Individual brokers report similar numbers: 60–83% fail.

Why? The answer has eight main reasons. Each one is preventable. Understanding them helps you avoid costly mistakes.

Poor Risk Management Destroys Accounts

Risk management is the most valuable reason traders fail. Over 43% of account failures come from bad position sizing.

Here’s the problem:

- Most traders risk 8–15% per trade

- Experts recommend risking only 1%

- Bigger risks equal bigger losses

When traders lose, desperation kicks in. They risk even more. Their accounts disappear in 3–8 weeks.

Stop-loss orders are critical. Yet 31% of traders fail because they don’t use them properly. Some set them too close. Others move them when losing. This turns small losses into huge ones.

The math is simple: traders with a 1:1 risk-reward ratio succeeds 3 times more often. They protect their money first. Profits come second.

Leverage Is a Double-Edged Sword

Leverage amplifies wins and losses equally. Brokers offer 1:50, 1:100, even 1:500 leverage ratios. Think about this: At 100:1 leverage, a 1% price move = 100% account loss.

Example: You have $10,000. You use 50:1 leverage to control $500,000. The trade moves 100 pips against you. You lose $4,150—that’s 41% of your account.

Leverage feels great during winning trades. But one bad trade wipes out everything. Most traders overleveraging doesn’t survive.

Recent data shows traders now avoiding excessive leverage. Smart traders prioritize survival over huge profits. They use lower leverage and smaller positions.

Most Traders Lack Basic Knowledge

90% of beginners lose money due to poor education. They think YouTube videos equal trading expertise.

The forex market is complex:

- Currency prices depend on interest rates

- Job reports move markets dramatically

- Political events create volatility

- Economic data shifts trends

Without understanding these factors, traders guess blindly. Guessing always leads to losses.

Here’s the ugly truth: 95% of trading educators can’t trade profitably themselves. They sell courses without real trading experience. This makes learning nearly impossible.

Quality education takes time. But it’s worth it. Traders who invest in learning outperform those who wing it.

Emotion Control Trading Decisions

Emotions drive 85% of trading results. Fear and greed destroy accounts faster than any market crash.

Common emotional mistakes include:

- Fear prevents entering winning trades

- Greed causes over-leveraging

- Anger triggers revenge trading

- Overconfidence leads to massive losses

Revenge trading is particularly destructive. Traders lose. Then anger takes over. They double or triple position sizes without thinking. One trader lost an entire $1,200 account in three hours this way.

After winning streaks, overconfidence grows. Traders abandon their rules. They take crazy risks. Then a normal market move destroys them.

Successful traders manage emotions with simple rules: fixed position sizes, daily loss limits, and mandatory breaks.

Trading Without a Plan = Guaranteed Loss

A trading plan is your roadmap to profit. Without one, you’re just gambling.

A plan includes:

- When to enter trades

- When to exit trades

- How much to risk

- How to protect your money

- Performance metrics

Without a plan, traders make random decisions. Today they scalp. Tomorrow they hold positions for days. They switch strategies constantly.

This inconsistency prevents learning. You can’t improve what you don’t measure.

Expecting Too Much Too Fast

Get-rich-quick fantasies destroy real trading careers. Social media shows luxury lifestyles from “profitable traders.” Reality is different.

Let’s do the math:

- $1,000 account can’t generate $500 monthly

- That requires 50% monthly returns (impossible)

- Professional traders make 2–5% monthly (excellent)

Forex trading is not a shortcut to wealth. It’s a skill. Learning takes 1–2 years minimum.

Compare it to other professions:

- Doctors study 4+ years

- Lawyers study 4+ years

- Traders think they’ll profit in weeks

This mismatch between expectations and reality destroys accounts. Disappointed traders make emotional decisions.

Even experienced traders fail without plans. Beginners have zero chance. A trading plan is non-negotiable.

Overtrading Costs Money

Taking too many trades destroys accounts. After losses, desperate traders increase trade frequency.

Overtrading problems:

- Transaction costs pile up quickly

- Emotional exhaustion reduces decision quality

- Traders abandon their strategy

- Losses accelerate

Trading outside your strategy is overtrading. The urge comes from boredom, FOMO, or overconfidence.

Here’s the truth: more trades don’t equal more profits. After a certain point, additional trades mean lower returns.

Keep a trading journal. Track every trade. Identify which trades followed your plan. Notice which didn’t. This reveals your overtrading problem.

Starting with Too Little Money

Low startup capital forces terrible decisions. Traders think $100 or $1,000 is enough. It isn’t.

Small accounts create problems:

- Traders must over-leverage to profit

- One mistake wipe everything out

- Psychological pressure increases dramatically

- Normal market swings trigger margin calls

A $1,000 account trading 1% risk means $10 per trade. Can you live on $10 trades? No.Desperation sets in. Traders increase leverage. Then one losing trade destroys everything. Professional traders expect market downturns. They survive them. Undercapitalized traders don’t. Start with enough capital. Or skip trading until you save enough. Don’t rush into trading with money you’ll need.

How to Stop Losing Money

The 70–90% failure rate isn’t inevitable for you. The 10% who succeed do specific things differently.

Winning traders:

- Follow strict risk management rules

- Use appropriate leverage levels

- Invest in real education

- Control their emotions

- Trade from a written plan

- Set realistic expectations

- Trade only quality opportunities

- Start with adequate capital

Treat forex like a profession, not a game. Real professionals study for years before earning. You are your biggest obstacle. Markets aren’t the enemy. Human error causes failure, not market complexity. By understanding why forex traders lose money, you gain power. You can avoid each mistake. You can join the profitable 10–30%. Start today. Build discipline. Learn properly. Risk carefully. Then profits follow naturally.

What is the 2% rule in Forex trading?

Understanding the 2% Forex Trading Rule

The 2% forex trading rule is a simple risk management principle. It states you should never risk more than 2% of your total account on any single trade. This fundamental forex trading rule protects your capital. It prevents one bad trade from destroying your account. Think of it like insurance for traders. Small losses you can handle. Large losses destroy careers.

Why the 2% Forex Trading Rule Matters

Capital preservation is the foundation of successful trading. The 2% forex trading rule ensures you survive losing streaks. Most traders focus on profits. Professionals focus on protecting their money first. This mindset difference separates winners from losers. Here’s the math: With 2% risk, 10 consecutive losses leave you with 81.7% of your capital. With 10% risk, those same losses leave you with only 34.9%. After 15 losses, 2% risk leaves you with 74% remaining. But 10% risk leaves only 20.6%. The difference is survival versus failure.

How the 2% Forex Trading Rule Works

The forex trading rule applies to your current account balance. You recalculate risk as your balance changes. Example: You have $10,000 in your account. Your maximum risk per trade equals $200 (10,000 × 0.02). If you grow to $12,000, your new maximum risk becomes $240. If you drop to $8,000, your maximum becomes $160. This dynamic adjustment protects you during drawdowns. It also lets profits compound during winning periods.

Calculating Position Size Using the 2% Forex Trading Rule

Position sizing determines how many lots or shares to trade. This calculation ensures your risk stays at 2%.

Here’s the step-by-step process:

- Step 1: Calculate your dollar risk. Multiply your account by 2%. A $25,000 account = $500 maximum risk per trade.

- Step 2: Determine your risk per unit. This equals your entry price minus your stop-loss price. Example: Entry at $160, stop at $140 = $20 risk per share.

- Step 3: Calculate position size. Divide dollar risk by risk per unit. $500 ÷ $20 = 25 shares maximum.

- Step 4: Place your stop-loss order. This automatically limits your loss if the trade fails.

Real Forex Trading Rule Examples

Let’s see the 2% forex trading rule in action. These examples make the concept clear. Example 1: You have $50,000 capital. You want to buy EUR/USD. Your entry is 1.1000. Your stop-loss is 1.0950 (50 pips).

Your maximum risk: $50,000 × 0.02 = $1,000. If each pip equals $10 per standard lot, your 50-pip risk = $500 per lot. You can trade 2 standard lots maximum ($1,000 ÷ $500).

Example 2: You have $10,000 capital. You’re trading stocks. Entry price is $50. Stop-loss is $48. Risk per share is $2. Your maximum risk: $10,000 × 0.02 = $200. Position size: $200 ÷ $2 = 100 shares maximum.

Benefits of Following This Forex Trading Rule

The 2% forex trading rule offers multiple advantages. These benefits explain why professionals use it religiously. Protection from catastrophic losses: Even 50 losing trades won’t empty your account. This gives you room to learn and improve.

- Emotional stability: Knowing losses are limited reduces stress. You make rational decisions instead of emotional ones.

- Compound growth: Preserving capital during losses lets profits grow during wins. Small, consistent gains compound powerfully over time.

- Trading longevity: You survive long enough to become skilled. Most traders quit after blowing their accounts. This forex trading rule prevents that.

- Strategy flexibility: The 2% rule works with any trading style. Day trading, swing trading, and scalping all benefit from proper risk management.

- Consistency: Using percentages instead of fixed amounts adapts to your account size. Your risk management stays proportional.

Alternative Forex Trading Rules

The 2% rule isn’t the only option. Other forex trading rule variations exist for different risk profiles. The 1% rule is more conservative. Professional traders and prop firms often require 1% maximum risk. This extends survival even further. With 1% risk, your account can withstand longer losing periods. Many professional traders prefer this approach. It’s slower but safer. The 5% rule is more aggressive. Some experienced traders risk up to 5% on high-confidence setups. However, this requires proven strategies and discipline. Maximum risk exposure limits total risk across all trades. Many traders use 5% maximum exposure across multiple positions. Example: Three trades at 1.5%, 1.5%, and 2% total 5%.

Common Mistakes With the 2% Forex Trading Rule

Many traders misunderstand or misapply this forex trading rule. Avoiding these mistakes is crucial for success.

- Mistake 1: Using fixed dollar amounts instead of percentages. Your risk should adjust as your account changes. $200 risk is different on $5,000 versus $20,000.

- Mistake 2: Moving stop-losses during trades. You set stop-losses before entering. Never adjust them downward when losing.

- Mistake 3: Increasing risk to recover losses. Amateur traders’ risk more after losses. Professionals reduce position sizes or stop trading.

- Mistake 4: Believing one trade solves problems. This creates overconfidence and excessive risk-taking. No single trade should make or break you.

- Mistake 5: Ignoring the rule during winning streaks. Success breeds overconfidence. Discipline matters most when you’re winning.

How to Apply the 2% Forex Trading Rule Daily

Implementation requires discipline and consistency. Follow these practical steps every trading day.

- Morning routine: Check your account balance. Calculate your 2% risk for today. Write this number down or set it in your calculator.

- Before each trade: Identify your entry point. Decide where your stop-loss will be. Calculate your position size using the formula.

- Trade execution: Enter your position at the planned size. Immediately place your stop-loss order. Never trade without stop-losses.

- During trades: Don’t move stop-losses downward. Let your plan execute. Avoid emotional interference.

- After trades: Record results in a trading journal. Update your account balance. Recalculate your 2% for the next trade.

- Weekly review: Analyze if you followed the forex trading rule consistently. Identify any deviations. Adjust behavior if needed.

Why Professional Traders Use This Forex Trading Rule

Risk management separates amateurs from professionals. The 2% forex trading rule is an industry standard for good reason. Warren Buffett’s famous quote applies perfectly: “Rule #1: Never lose money. Rule #2: Never forget rule #1”. The 2% rule embodies this principle. Professional traders know markets are unpredictable. They can’t control whether individual trades win or lose. But they absolutely control how much each trade risks. Prop firms and professional trading organizations enforce 1-2% risk limits. They understand that protecting capital enables long-term success. The math proves it works. Trading with proper risk management becomes sustainable. Without it, trading becomes gambling.

Combining the 2% Rule with Other Strategies

The 2% forex trading rule works best with complementary strategies. These combinations enhance overall risk management.

- Risk-reward ratios: Combine 2% risk with 1:2 or 1:3 risk-reward targets. Example: Risk $200 to potentially make $400 or $600. This ensures winners compensate for losers. Even 50%-win rate becomes profitable.

- Stop-loss orders: The 2% rule requires stop-losses. These automatically execute exits. They prevent emotional decisions during losing trades.

- Portfolio diversification: Spread 2% risk across different currency pairs. Don’t concentrate risk in correlated positions.

- Position size adjustments: Reduce to 1% during uncertain markets. Increase toward 2% only when conditions favor your strategy.

- Daily loss limits: Stop trading if you lose 6% in one day. This prevents revenge trading and emotional destruction.

Recovery from Losses: Why the Forex Trading Rule Helps

Understanding drawdown recovery shows why 2% matters. Losses require disproportionate gains to recover. The math is brutal: A 10% loss requires 11% gain to recover. A 20% loss needs 25% gain. A 50% loss demands 100% gain. Larger drawdowns become nearly impossible to overcome. A 75% loss requires 300% gain to recover. The 2% forex trading rule prevents deep drawdowns. Small losses are manageable. You can recover from 10-20% drawdowns reasonably.

Compare two traders over 10 losses. Trader A risks 2% per trade. Trader B risks 10% per trade. Trader A needs 22% gain to recover. Trader B needs 186% gain to recover. One is achievable. The other is nearly impossible. This explains why the 2% forex trading rule is essential. It keeps you in the game.

Final Thoughts on This Forex Trading Rule

The 2% rule is your foundation for trading success. Every professional trader understands and applies this principle. Risk management isn’t optional. It’s the difference between sustainable trading and gambling. The 2% forex trading rule provides that structure.

Start today. Calculate your 2% risk. Apply it consistently to every trade. Your future trading self will thank you.

Remember: Trading success comes from protecting capital first. Profits follow naturally when you survive.

What is the most successful Forex trading strategy?

The Truth About Finding the Best Strategy

There’s no single “best” forex trading strategy for everyone. Success depends on your personality, risk tolerance, available time, and trading goals. Many beginners search for a magic formula. But professional traders know differently. The most successful forex trading strategy is one that matches your lifestyle and you can execute consistently.

Research shows that 4-hour to daily timeframe strategies have the highest success rates among retail traders. This guide explores proven forex trading strategy options that work in 2025.

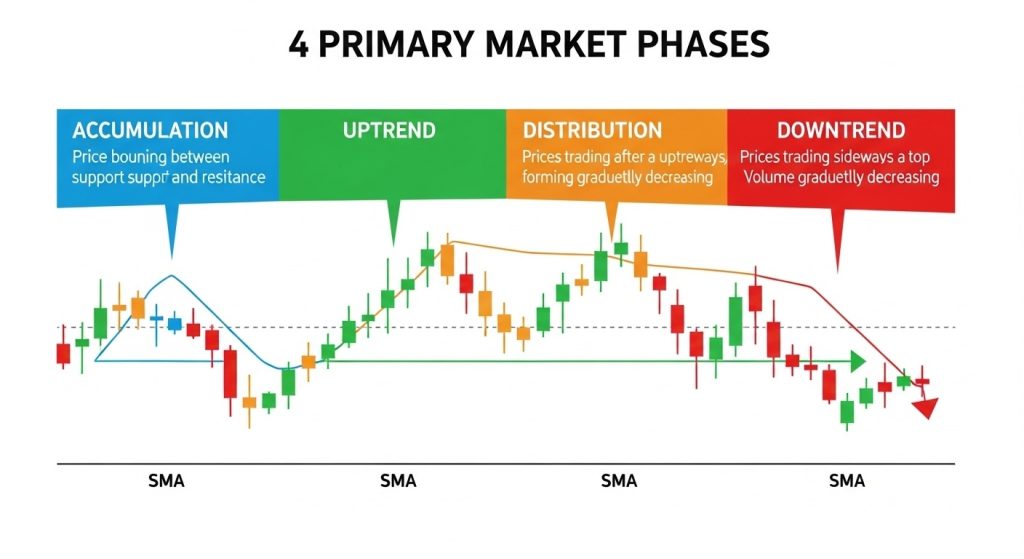

Trend Following: The Most Reliable Forex Trading Strategy

Trend following remains the most reliable forex trading strategy. It involves identifying market direction and trading with that trend, not against it. This forex trading strategy uses technical indicators like moving averages, MACD, and RSI. When EUR/USD consistently moves upward, trend traders buy. When it moves downward, they sell.

Why it works: Markets trend about 30% of the time. But those trending periods offer the biggest profit opportunities. Trend followers capture major price movements by riding momentum. Beginners love this forex trading strategy because it’s simple.

Draw trendlines connecting higher highs and higher lows. Enter trades when price respects these levels. Professional traders trail stop-losses to maximize gains. They never use fixed profit targets. This lets winners run while cutting losers short.

Breakout Trading: Capturing Strong Movements

Breakout trading capitalizes on explosive price moves. This forex trading strategy enters positions when price breaks through significant support or resistance levels. Look for high volume confirming the breakout. Volume signals genuine momentum versus false breakouts. Without volume confirmation, many breakouts fail. Experienced traders wait for clear breakout signals. They don’t jump at the first sign.

Patience prevents losses from fake breakouts that reverse quickly. Stop-losses belong just below the breakout candle. This protects capital if the breakout fails. Risk management remains crucial with any forex trading strategy.

Swing Trading: Perfect for Part-Time Traders

Swing trading offers the best risk-adjusted returns for part-time traders. This forex trading strategy holds positions for several days to weeks. Unlike day trading, swing trading doesn’t require constant screen time. You analyze markets once or twice daily. Then you let trades develop. Swing traders combine technical and fundamental analysis. They identify medium-term price movements using chart patterns and economic data. Positions typically last 3-10 days. This timeframe reduces stress while still offering excellent profit potential.

Scalping: High-Speed Trading for Active Traders

Scalping executes numerous small trades throughout the day. This intense forex trading strategy captures minimal price moves in seconds or minutes. Scalpers make dozens or hundreds of trades daily. Each trade targets 5-10 pips profit. Small gains accumulate into meaningful daily profits. This forex trading strategy requires intense focus and discipline. You need tight spreads and high liquidity. Major pairs like EUR/USD and GBP/USD work best.

Warning: Scalping isn’t for beginners. Transaction costs accumulate quickly. Emotional pressure intensifies with high trade frequency.

Position Trading: Long-Term Strategy for Patient Traders

Position trading holds trades for months or even years. This long-term forex trading strategy focuses on major market trends and fundamental factors. Position traders ignore daily price fluctuations. They analyze interest rates, economic growth, inflation, and geopolitical events.

This approach requires patience and deep market understanding. But it offers lower stress compared to short-term strategies. Position traders capture huge moves that develop slowly. One successful trade can generate months of profits.

Price Action Trading: Reading Market Behavior

Price action trading analyzes raw price movements without indicators. This pure forex trading strategy reads what the market is actually doing. Traders study candlestick patterns, support and resistance levels, and chart formations. No indicators cluttering charts. Just clean price bars. Common patterns include pin bars, inside bars, and engulfing candles.

These signals show market sentiment and potential reversals. Price action works on all timeframes and markets. The patterns repeat because human psychology remains constant. Professional traders prefer this forex trading strategy for its simplicity. You see exactly what price is doing without lagging indicators.

Carry Trade: Profiting From Interest Rate Differences

Carry trades profit from interest rate differentials between currencies. This unique forex trading strategy generates income even when price stays flat. Example: Borrow Japanese yen at 0.10% interest. Buy Australian dollars earning 4.35% interest. You earn the 4.25% difference.

Popular carry pairs include AUD/JPY and NZD/JPY. These pairs offer substantial interest spreads. This forex trading strategy works best in stable markets. When exchange rates remain steady, you collect daily interest payments.

Risk warning: Currency movements can erase interest gains quickly. If the high-yield currency drops, losses exceed interest earned.

Range Trading: Profiting From Sideways Markets

Range trading buys at support and sells at resistance. This forex trading strategy excels in stable, sideways markets. Identify clear price channels where currency pairs bounce between levels. Buy when price reaches the bottom. Sell when it reaches the top. Range trading requires patience. Wait for price to reach channel boundaries.

Don’t chase price in the middle of ranges. This forex trading strategy fails during breakouts. Always use stop-losses outside the range to protect against sudden breakout moves.

Choosing Your Best Forex Trading Strategy

Match the forex trading strategy to your personality and schedule. Honest self-assessment determines which approach suits you best. Ask yourself these questions: How much time can you dedicate daily? Can you handle stress? Do you prefer fast action or patient waiting? Day traders need hours of screen time.

Swing traders need 30-60 minutes daily. Position traders analyze weekly. Risk tolerance matters equally. Scalping and breakout strategies involve higher stress. Swing and position trading offer calmer experiences. Test strategies on demo accounts first. Practice until execution becomes natural. Never risk real money before proving profitability on paper.

Essential Elements for Any Forex Trading Strategy

Risk management determines long-term success more than entry precision. Every profitable forex trading strategy includes proper risk management. Risk only 1-2% per trade maximum. Calculate position size based on account balance and stop-loss distance. Use stop-loss orders on every trade. Stops protect capital when trades move against you. Never trade without stops.

Keep detailed trading journals. Record every trade with entry reasons, exit reasons, and emotions felt. Review monthly to identify patterns. Multiple timeframe analysis improves accuracy. Check higher timeframes for trend direction. Enter on lower timeframes for better prices.

Adapting Your Forex Trading Strategy to Market Conditions

Successful traders adapt strategies to changing market environments. Markets shift between trending, ranging, and volatile conditions. Use trend-following strategies during clear trends. Switch to range trading during sideways markets. Avoid trading during extreme volatility unless experienced. Market state classification systems identify current conditions. Maintain separate strategy modules optimized for different environments.

Regular performance reviews reveal condition-based weaknesses. Adjust your forex trading strategy when performance declines. Professional traders in 2025 excel at this adaptability. They recognize when to trade aggressively and when to wait.

Technology-Enhanced Forex Trading Strategies

Algorithmic and AI-enhanced approaches show increasing profitability. Technology provides systematic advantages in execution and emotion management. Machine learning identifies patterns invisible to humans. These systems adapt to changing market conditions automatically. High-frequency trading exploits small price discrepancies using lightning-fast technology. However, this requires significant technical expertise and capital.

Most retail traders benefit from simpler automation. Automated trade execution removes emotional interference. Hybrid systems combining algorithms with human oversight work best. Technology handles execution. Humans make strategic decisions.

Common Mistakes That Destroy Forex Trading Strategies

Even the best forex trading strategy fails without proper execution. These mistakes sabotage potentially profitable approaches. Trading without a plan guarantees failure. Write your strategy rules down. Follow them consistently. Overtrading destroys accounts quickly. Quality trades beat quantity. Wait for proper setups matching your forex trading strategy. Ignoring risk management causes catastrophic losses.

Position sizing and stop-losses aren’t optional. They’re mandatory for survival. Revenge trading after losses multiplies damage. Take breaks after losing streaks. Return when emotions settle. Constantly switching strategies prevents mastery. Commit to one forex trading strategy for 6 months minimum. Give it fair testing before changing.

Building Your Path to Trading Success

Consistent profitability requires time, practice, and discipline. No forex trading strategy produces instant wealth. Professional-level skills take 1-2 years to develop. Compare this to any other profession. Doctors and lawyers study for years. Start with education and demo trading.

Master one forex trading strategy completely. Then add live capital gradually. Track everything in detailed journals. Analyze monthly performance. Identify what works and what doesn’t. The winning forex trading strategy for you combines proven methods with your unique strengths. Find that match. Then execute relentlessly with discipline.

What is the biggest secret in Forex trading?

The Real Secret Professional Traders Know

The biggest secret in forex trading isn’t a strategy, it’s discipline. Most beginners search for magic formulas. Professional traders focus on executing consistent rules.

Successful traders understand that 80-90% of trading success comes from psychology and discipline, not indicators. This fundamental truth separates profitable traders from the 90% who lose money.

A disciplined trader with an average strategy outperforms an undisciplined trader with a great system. Strategy can be learned quickly. Discipline takes years to master.

Capital Preservation: The Overlooked Secret

The biggest secret to long-term forex trading success is protecting capital first. Avoiding large losses matters more than making large profits. Paul Tudor Jones, one of history’s greatest traders, states: “The most important rule of trading is to play great defense”. Defense means preserving money. Offense means pursuing profits.

Why? Because traders with adequate capital survive long enough to profit. Those who blow accounts never get a second chance. The math proves it: A 50% loss requires 100% gain to recover. A 10% loss requires 11% gain to recover. Protection is easier than recovery.

Patience: The Secret Nobody Wants to Hear

The biggest secret successful forex traders never share is that they do nothing most of the time. Professional traders wait for perfect opportunities. Research shows that forex professionals spend 90% of time waiting and analyzing. Only 10% involves actual trading.

Forex traders do the opposite, they trade constantly. This patience distinction causes massive performance differences. Overtrading from boredom or anxiety destroys accounts. Sitting on your hands, when no clear opportunity exists, is the secret weapon. It prevents the emotional trades that eliminate most traders.

The Compounding Secret: Exponential Account Growth

Reinvesting profits instead of withdrawing them creates the compounding miracle. This mathematical secret multiplies wealth exponentially. Example: Start with $10,000. Earn 10% monthly profit. Reinvest it. After 12 months, your balance reaches $31,384. One year transforms $10,000 into $31,384. Compare this to drawing profits monthly.

After 12 months, you’d have roughly $12,000. The difference? Compounding created an extra $19,384. Albert Einstein called compounding the “eighth wonder of the world”. He said: “Compound interest is the most powerful force in the universe”. The secret isn’t complexity. It’s reinvesting small consistent gains. Five trades monthly at 2% risk each equals 10% monthly compounding.

Risk Management: The Non-Negotiable Secret

Risk management is the secret that separates professionals from amateurs. Professionals risk only 1-2% per trade. Forex traders risk 8-15%. Institutional traders follow this rule religiously. If they violate it once, their entire career ends.

Why? Because proper risk management is a guarantee for survival. If you manage risk correctly, you can’t help but eventually profit. Stop-loss orders are non-negotiable. Never trade without them. Position sizing calculations must precede every trade.

Price Action: The Secret Over-Complicated Strategies Miss

Professional traders know that price action is more powerful than complicated indicators. Raw price movement reveals market psychology. Successful forex traders use price action in some form. Whether analyzing candlestick patterns, support/resistance, or volume, they read price behavior.

Most beginners fill charts with dozens of indicators, making decisions impossible. Professional traders use clean charts with minimal tools. Price action shows you where traders buy and sell. Understanding market psychology through price improves all strategies.

Emotional Discipline: The Psychology Secret

The secret professionals know is that emotion, not market analysis, causes 90% of trading failures. Fear, greed, and impatience destroy more accounts than bad strategies. Successful traders have systems to manage emotions automatically. They set daily loss limits. They take breaks after losses. They refuse revenge trades.

Professional firms employ compliance desks monitoring traders for emotional discipline violations. One breach of emotional control can end careers. Forex traders trade emotionally. They chase losses. They overtrade winning streaks. This emotional trading costs fortunes.

The Trading Journal Secret Nobody Implements

Keeping detailed trading journals is the secret successful traders never ignore. Journals prevent repeating costly mistakes. Record every trade: entry reason, exit reason, emotions felt, money won, money lost. Review monthly to identify patterns and weaknesses.

When you see a setup that previously failed, your journal reminds you. This prevents revenge trading on bad patterns. Successful traders spend hours analyzing journal data. Amateurs never look back at their trades.

The Simplicity Secret: Complexity Kills Accounts

The biggest secret professional traders protect is that simple strategies outperform complex ones. Overcomplication creates confusion and emotional mistakes. Traders need to master only 2-3 strategies maximum. Mastering one strategy completely beats knowing ten poorly.

Complex systems with dozens of indicators confuse execution. Simple rules following a clear plan execute consistently. Research shows that trading simplicity directly correlates with profitability. The most successful traders keep strategies straightforward.

Market Time and Experience: The Hidden Secret

The secret professionals know is that experience beats expertise for predicting success. Real trading experience cannot be learned from courses. You need painful experience losing real money to develop genuine trading skills. This painful education cannot be rushed.

Screen time matters enormously. The more hours you’ve spent observing markets, the better your decisions become. Professional traders inside hedge funds trained for years before managing money. Forex traders expect profits in weeks.

Why Profitable Traders Rarely Share Their Methods

The biggest secret is that successful traders don’t reveal real strategies because markets change. Once a strategy becomes common, institutions exploit it. When 90% of traders use support/resistance breakouts, institutions hunt those stop-losses. The strategy stops working because too many people know it.

Experienced traders develop personalized approaches specific to their trading niches. These customized methods rarely transfer perfectly to other traders. Most traders lie about their profitability or strategies anyway. The true winners stay silent.

The Discipline vs. Strategy Paradox

Here’s the secret paradox: 80% comes from discipline, only 20% from strategy. Yet beginners obsess over strategy while ignoring discipline. A profitable strategy without discipline fails consistently. A mediocre strategy with exceptional discipline succeeds reliably.

Professional firms focus recruitment on disciplined people, not trading geniuses. They trust discipline to implement any reasonable strategy. The biggest secret is accepting this uncomfortable truth: Your strategy matters less than you think.

How to Implement These Secrets

Start by accepting these secrets, then implementing them slowly. Rome wasn’t built in one day. Trading skill develops gradually. Write your trading plan, including rules, and stick to it. Never deviate when emotions surge. Your plan handles emotions.

Risk only 1-2% per trade maximum. This single rule provides survival and eventual profitability. Keep a detailed trading journal. Review weekly. Identify mistakes. Prevent repeats. Trade simple strategies with few indicators. Simplicity breeds consistency. Consistency breeds profits.

The Ultimate Forex Trading Secret

The ultimate secret is this: There are no secrets, only discipline applied consistently. Profitable trading combines known strategies with unyielding discipline. Everyone can access the same information, indicators, and market data. Professionals profit not from secret knowledge but from superior discipline.

The difference between professionals and amateurs is simple: Amateurs trade. Professionals stick to plans. Master discipline. Control emotions. Protect capital. Follow your rules consistently. These boring truths, not magic secrets, create long-term forex trading wealth.