Understanding the Forex Market

Forex trading for beginners starts with grasping how the global currency market operates. Traders buy and sell currency pairs, such as EUR/USD or GBP/JPY, seeking to profit from fluctuating exchange rates. Unlike stocks, forex operates 24 hours a day across multiple time zones, offering high liquidity and leverage options. Familiarizing yourself with key terms like pips, lots, and margin lays the groundwork for informed decision-making.

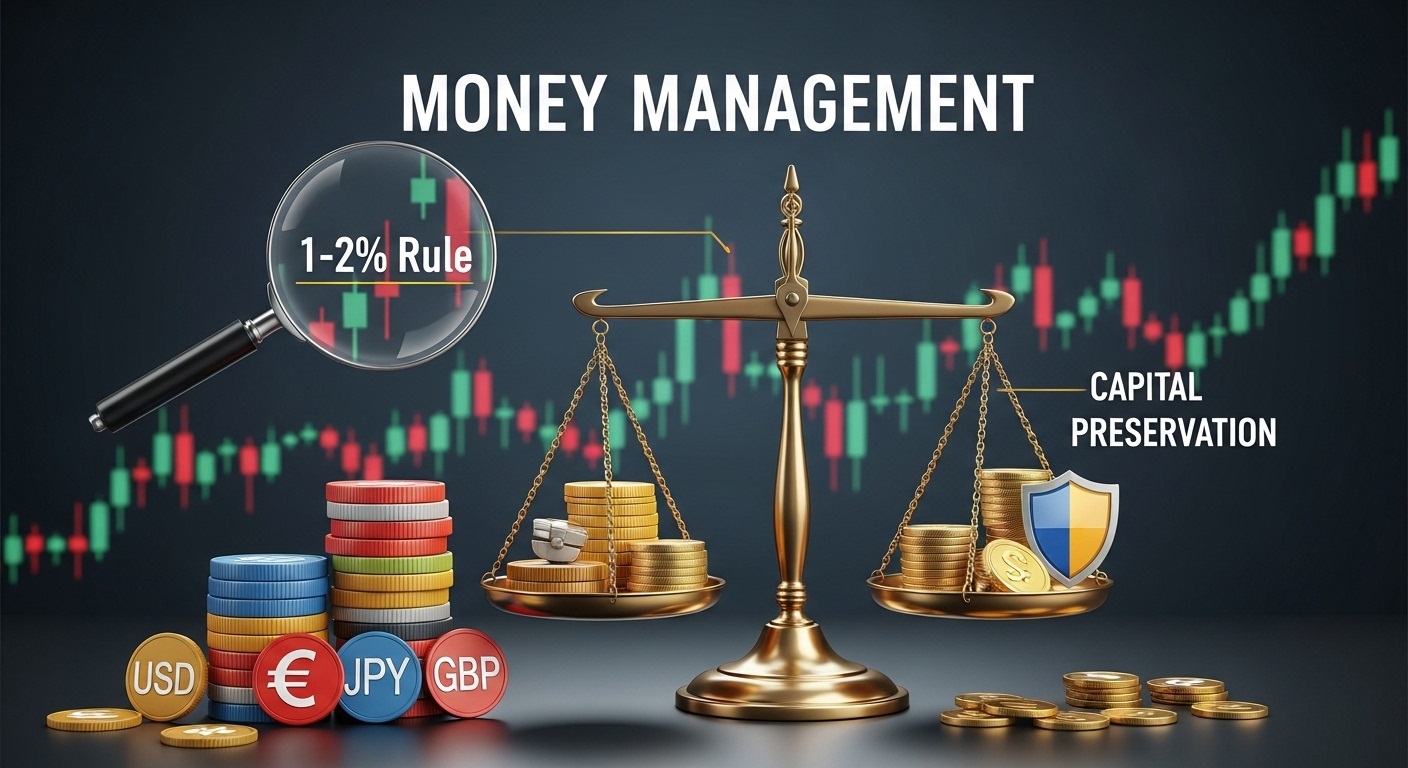

Building a Solid Trading Plan

A structured trading plan is essential for forex trading for beginners. Start by defining clear goals, risk tolerance, and preferred trading style, scalping, day trading, or swing trading. Incorporate Money Management rules to limit risk to 1-2% of your capital per trade. Use technical and fundamental analysis tools, such as trend indicators and economic calendars, to identify entry and exit points. Consistency in following your plan prevents impulsive decisions driven by market noise.

Practicing with Demo Accounts

Demo accounts empower forex trading for beginners to hone strategies without risking real capital. Use virtual funds to test different currency pairs, timeframes, and Money Management techniques. Track performance in a trading journal, noting wins, losses, and emotional triggers. Transitioning to live trading only after achieving consistent demo results builds confidence and reduces psychological stress.