Protecting Your Capital

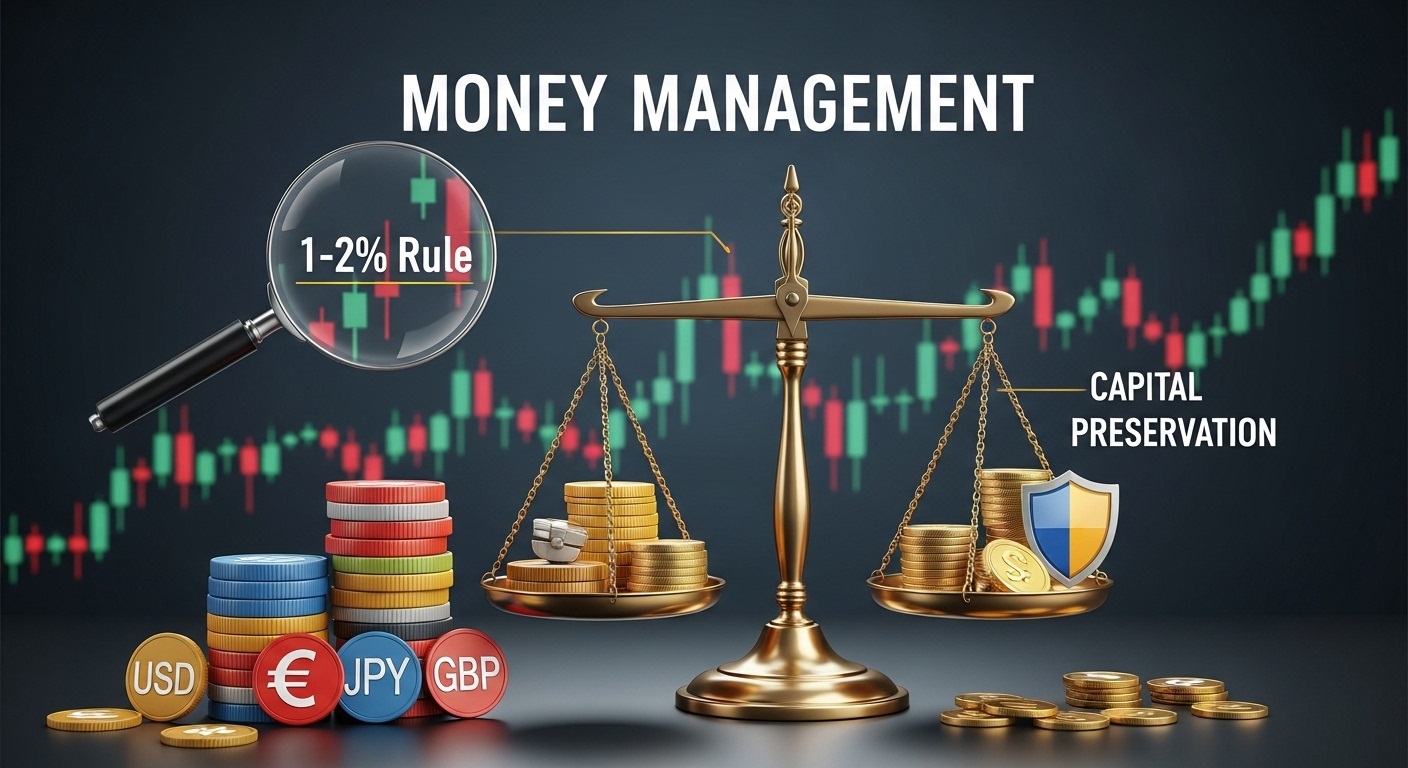

Effective Money Management is the cornerstone of successful forex trading. By defining precise risk parameters for each trade, you safeguard your account balance against sudden market swings. Consistently applying position sizing and stop-loss levels prevents catastrophic losses, ensuring your trading journey remains sustainable and secure.

Enhancing Long-Term Profitability

Enhancing Long-Term Profitability

Adopting disciplined Money Management techniques transforms sporadic gains into enduring success. Through calculated risk–reward analysis and systematic allocation of trading capital, you maximize potential returns while controlling drawdowns. This strategic framework empowers traders to compound profits over time and steadily grow their equity.

Minimizing Emotional Trading

Robust Money Management rules remove emotion from decision-making, reducing impulsive trades driven by fear or greed. Establishing clear guidelines for loss limits and profit targets cultivates a rational mindset. This psychological edge helps maintain consistency, as traders stick to their plan and avoid costly, emotion-fueled mistakes.