Understanding Money Management Basics

Effective money management is the cornerstone of trading success. It involves allocating capital wisely, setting clear risk limits, and ensuring that each trade contributes positively to your overall portfolio. By mastering foundational principles, beginner traders can avoid catastrophic losses and build consistent growth.

Setting a Realistic Trading Budget

Before placing your first trade, determine how much capital you can afford to risk without impacting your lifestyle. This budget should be separate from your emergency funds. A realistic budget prevents emotional decision-making and keeps you disciplined, ensuring you trade within your financial comfort zone.

Determining Risk per Trade

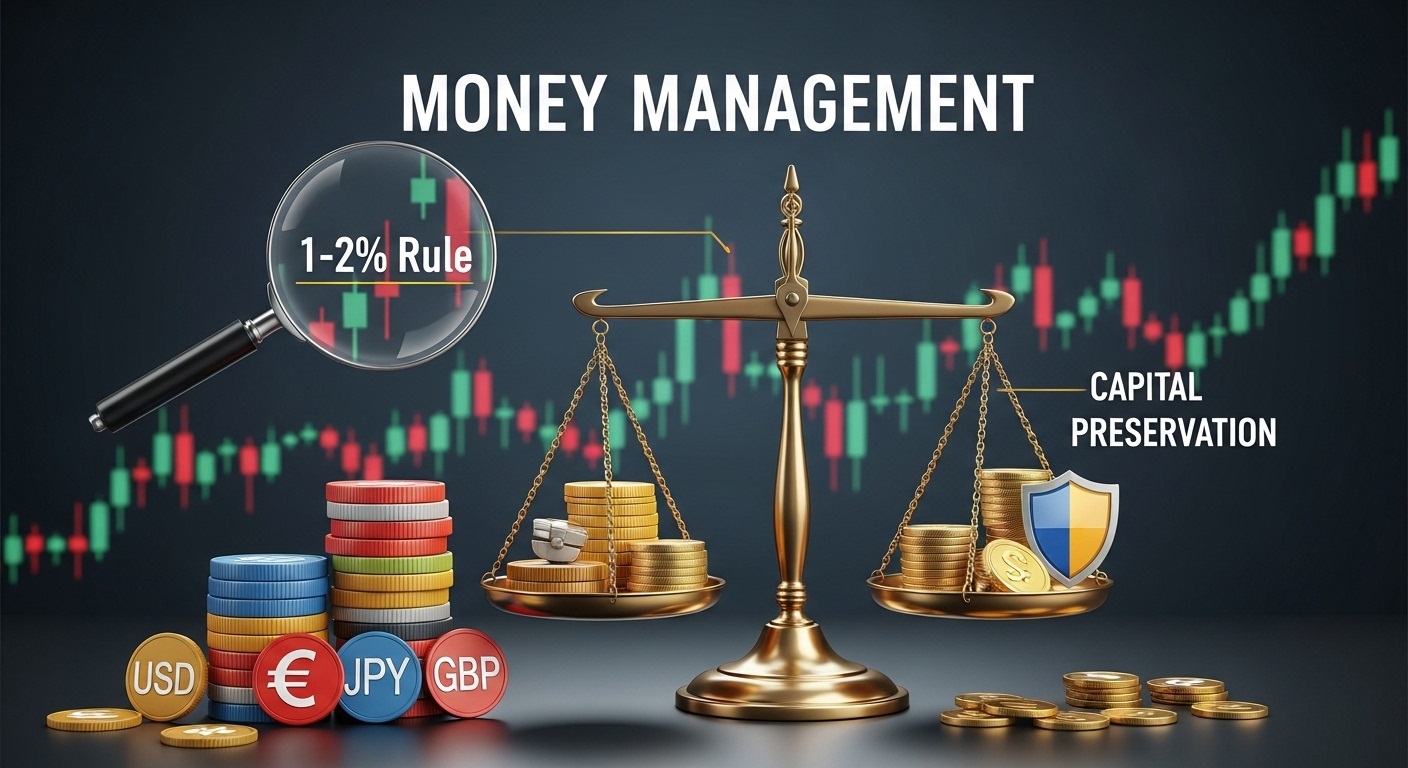

Determining Risk per Trade

A core aspect of money management is deciding what percentage of your trading capital to risk on each position. Many professionals recommend risking no more than 1–2% per trade. By keeping risk small, even a series of losing trades won’t deplete your account, preserving capital for future opportunities.

Implementing Stop-Loss Orders

Stop-loss orders are essential tools for controlling losses. They automatically close your position at a predefined price, preventing runaway losses. Combining stop-loss placement with proper position sizing ensures that each trade’s maximum loss aligns with your predetermined risk tolerance.

Using Profit Targets and Trailing Stops

Just as stop-loss orders protect against excessive losses, profit targets and trailing stops lock in gains. Set realistic profit objectives based on market analysis, and consider trailing stops to ride favorable trends while safeguarding profits. This balanced approach maintains discipline and prevents greed from eroding gains.

Diversifying Your Trading Portfolio

Diversification spreads risk across multiple instruments or markets. Rather than concentrating on a single currency pair or stock, allocate capital among different assets with varying correlations. This strategy reduces the impact of any single position’s poor performance, promoting stability in your returns.

Calculating Position Size Accurately

Calculating Position Size Accurately

Position sizing ensures that you don’t overcommit on a trade. Use the formula:

\text{Position Size} = \frac{\text{Account Risk ($)}}{\text{Stop-Loss Distance (pips or price units)}}

Accurate calculations help maintain consistent risk levels and prevent emotional decision-making.

Maintaining a Trading Journal

Document every trade by recording entry and exit points, position size, risk-reward ratio, and emotions during the trade. A trading journal reveals patterns in your behavior and strategy performance, enabling ongoing refinement of your money management techniques.

Controlling Leverage Usage

Leverage can amplify both profits and losses. Beginner traders should use low leverage or none at all until they gain experience. Limiting leverage reduces the likelihood of margin calls and allows you to manage positions more comfortably under volatile market conditions.

Adapting to Market Conditions

Markets evolve, and so should your money management plan. When volatility spikes or trends shift, adjust stop-loss distances, reduce position sizes, or temporarily scale back trading frequency. Flexibility ensures your risk controls remain effective under changing dynamics.

Emotional Discipline and Patience

Even with solid money management rules, emotions can undermine your trading. Fear and greed lead to impulsive decisions that break risk limits. Cultivate discipline by sticking to your plan, taking breaks after losses, and avoiding overtrading. Patience is essential for consistent success.

Final Thought

Prioritizing robust money management lays the groundwork for a sustainable trading journey. By combining proper risk allocation, disciplined execution, and continuous learning, beginner traders can navigate volatile markets with confidence and resilience.